Life Insurance in and around Bloomington

Get insured for what matters to you

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Monroe Co

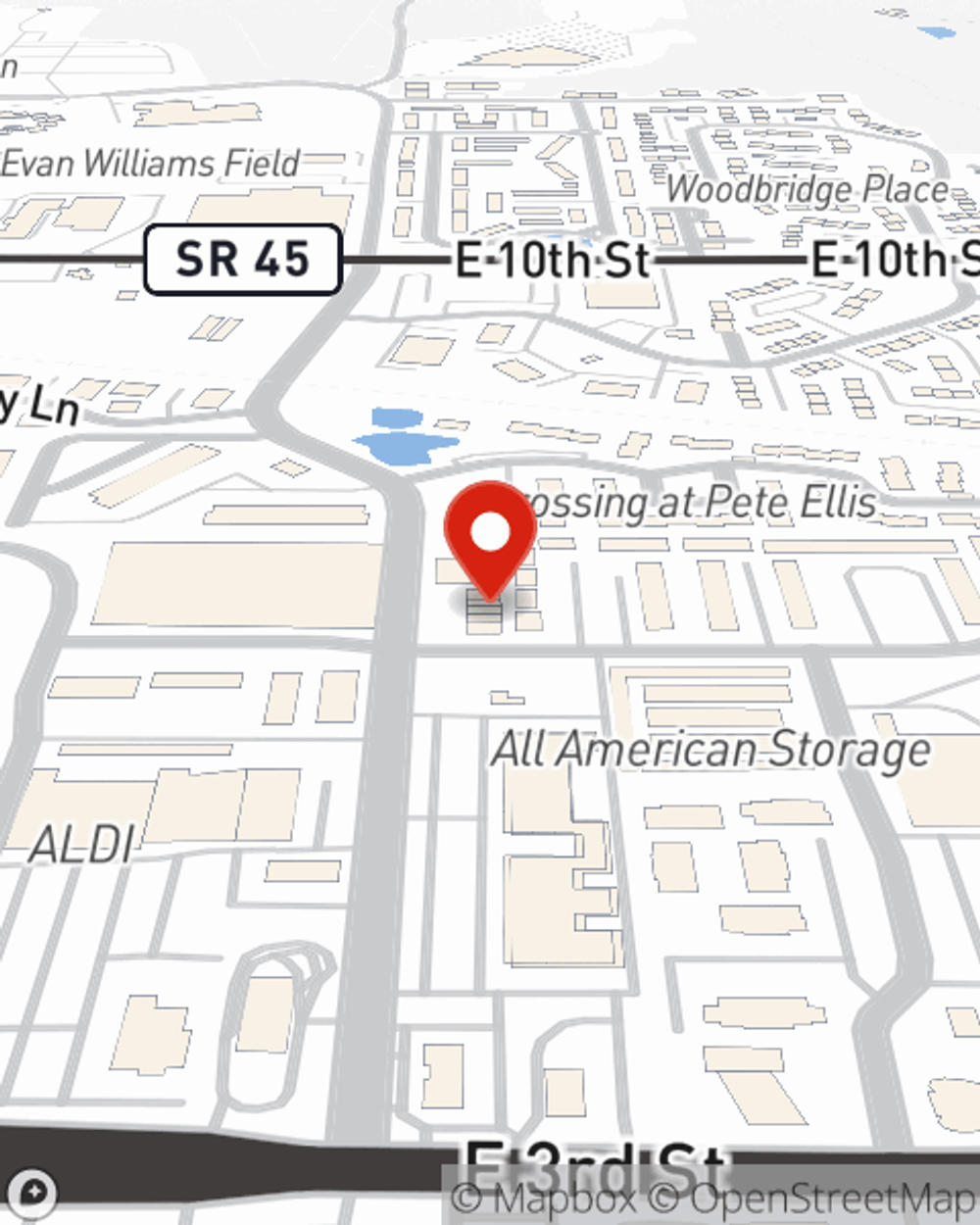

- Bloomington, IN

- Indiana University

- Unionville, IN

- Nashville, IN

- Martinsville, IN

- Bedford, IN

- Spencer, IN

- Ellettsville, IN

Check Out Life Insurance Options With State Farm

Do you know what funerals cost these days? Most people aren't aware that the standard cost of a funeral in the U.S. is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot manage that expense, they may fall on hard times in the wake of your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it maintains a current standard of living, pays off debts or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones.

Get insured for what matters to you

Now is the right time to think about life insurance

Why Bloomington Chooses State Farm

Fortunately, State Farm offers several policy choices that can be modified to fit the needs of your family members and their unique situation. Agent Vanessa Oden has the personal attention and service you're looking for to help you settle upon a policy which can aid your loved ones in the wake of loss.

Simply call or email State Farm agent Vanessa Oden's office today to learn more about how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Vanessa at (812) 336-6593 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Vanessa Oden

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.